Table Of Content

Then provide this list to the appraiser with any supporting documentation – like receipts or invoices – to prove you made these upgrades. This will help the appraiser see the extra value you have added to the home, and it just may help them justify their final appraised value of the property. Learn the differences between refinance vs. purchase appraisals, how they work and your options. Knowing the difference between appraised value vs. market value is key when purchasing a home.

How much does an appraisal cost?

When an appraisal matches the sales price, it’s good news for the buyer. Since any difference between the sales price and the appraised value falls to the buyer, having a matching appraisal value and sales price creates a straightforward path to homeownership — with no surprises for your budget. In cases where a lender isn’t involved in a home sale, the entire appraisal process — ordering it, scheduling it and paying for it — is up to the buyer.

Home Remodeling Projects to Boost Your Property Value in Omaha

If you have extra money to bring to the table, this might not be a problem. But if you don’t have extra cash on hand, a low appraisal might mean you can’t secure the financing you need. If the appraisal comes in low versus what you think your home’s value is, you likely want to dispute that in some way. One option could be to print out a list of similar homes in the community and show that they were valued at a higher price than your home. You may have the option to appeal the appraisal, but note you’ll likely need to support your argument and the appraiser may not change their appraisal. If you are working with a Realtor, they may be able to provide examples of comparable homes being of higher value.

What buyers and sellers should know about appraisals

Here's what you need to know about your Bexar County home appraisal - San Antonio Express-News

Here's what you need to know about your Bexar County home appraisal.

Posted: Thu, 18 Apr 2024 07:00:00 GMT [source]

The two-bed, two-bath home sits on a quarter-acre lot, and Putman boasted the gardens and terraces as a draw for potential buyers. Plus, it has a great view of the city, she said, making it the ultimate LA outdoor space. “When we value, we value on a very massive basis, so we value up a bunch of 1,998-2,000 square foot brick veneer homes that are similarly located,” Chief Appraiser Dana Horton said. Among its features are a bar and wet bar and an atrium, a basement, foyer, great room, laundry room, sauna, utility room, wine cellar and workshop. The rest of the property includes rare features such as a private tennis court, a heated pool and spa, biking and horse trails and a four-car garage.

Amid rising home appraisal protests, Montgomery County hosts property tax workshops - Community Impact

Amid rising home appraisal protests, Montgomery County hosts property tax workshops.

Posted: Tue, 16 Apr 2024 07:00:00 GMT [source]

What information is used to calculate the Redfin Estimate?

"After they fraudulently obtain title to your home, they can sell the property, they can borrow against it, but it is important to remember these are hypotheticals," said Arash Sadat, a real estate attorney. The Redfin Estimate is updated daily for homes that are for sale, and weekly for those that are off the market. Terry Castleman is a data reporter on the Fast Break Desk covering breaking news. In 2020, he was named alongside his colleagues as a Pulitzer Prize finalist in explanatory reporting. Previously, he worked at the New York Times and volunteered as a first responder for refugees arriving on the shores of Lesvos.

As a seller, a low appraisal means you may have to lower your home’s price to get it sold. Holding out for an all-cash buyer who doesn't require an appraisal as a condition of completing the transaction is unlikely to work. When you’re buying a home and are under contract, the appraisal will be one of the first steps in the closing process.

The appraiser also considers the neighborhood surrounding the property. A newer home in a growing subdivision might appraise higher than an old home in a community that’s in decline, for instance. While an appraiser’s job is to be as objective as possible, creating a welcoming environment is important for making a good first impression. Light and bright spaces are more inviting so bring in as much natural light as possible by opening up any blinds or curtains and make sure to keep the lights on throughout your home. Add soft touches to the interior with pillows or blankets to add a look of comfort, and set your thermostat to a comfortable temperature.

In most cases, the buyer pays for the home appraisal as part of their closing costs. If a home sale should fall through, the buyer is still required to cover the appraisal expense. When you get your home appraisal report, you’ll likely jump to the page that includes the final appraisal value. If the value is the same or very close to the proposed sales price, there shouldn’t be any complications with the loan. The appraiser usually takes photos of the various parts of the home during the walk-through. The appraiser handles the home visit individually, but homeowners might be present, especially if they are still living in the home.

If your existing mortgage is an FHA mortgage, you can refinance without an appraisal through the FHA streamline program—a great option for underwater homeowners. Because the appraisal primarily protects the lender's interests, the lender will usually order the appraisal to be done. If you have a VA loan You can use an interest rate reduction refinance loan (IRRRL) to refinance without an appraisal. If you have an FHA loanYou can avoid appraisal by refinancing through the FHA streamline program.

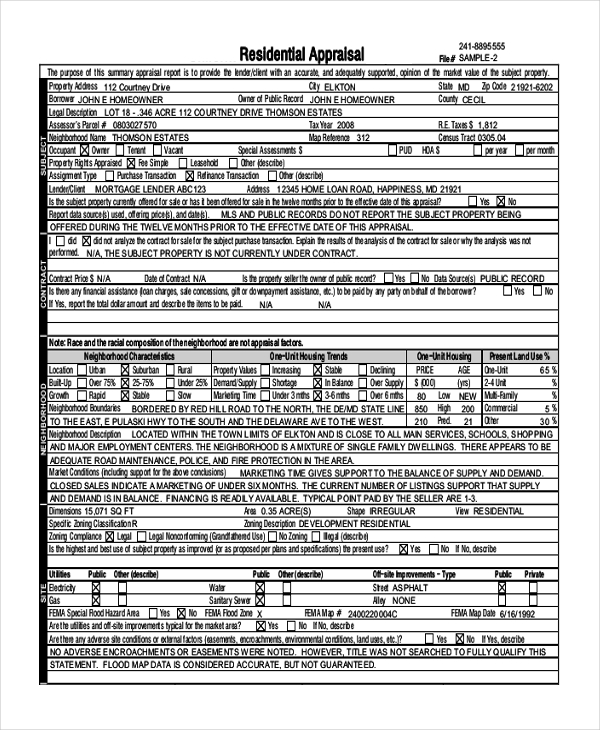

An appraisal for an average home usually costs $300 to $450, which is usually paid by the buyer. The entire home appraisal process usually takes a minimum of seven days. If you have a USDA loanRural homeowners who meet income and other requirements can avoid an appraisal by refinancing through the streamlined assist refinance program. If you’d like a more extensive look at what factors are considered in a home appraisal, look at the Uniform Residential Appraisal Report, which is the form used by most appraisers. Homeowners who are refinancing need to make sure the appraised value hasn’t slipped since they bought the home.

As residents across urban California have decamped for more space and affordability in the exurbs, small towns statewide have grown in popularity. Our appraisal reports meet the highest industry standard as required by Insurers, Government Agencies, and the Courts. ✝ To check the rates and terms you may qualify for, SoFi conducts a soft credit pull that will not affect your credit score. However, if you choose a product and continue your application, we will request your full credit report from one or more consumer reporting agencies, which is considered a hard credit pull and may affect your credit.

As a real estate brokerage, Redfin has complete access to Multiple Listing Services (MLSs), the databases that real estate agents use to list properties. To calculate the Redfin Estimate the algorithm considers hundreds of data points about the market, the neighborhood, and the home itself, like whether it has a water view or is located on a busy street. When all of this data meets the massive computing power of our proprietary machine-learning software and today’s best cloud technology, you get the Redfin Estimate. The Redfin Estimate is highly accurate, with a current median error rate of just 2.02% for homes that are for sale, and 6.28% for off market homes. This means that when a home that is currently on the market sells, the Redfin Estimate will be within 2.02% of the sales price half of the time.

And this helpful tool is updated regularly to factor in the latest fluctuations of the market, providing you with the most accurate, up-to-date information. The key ingredient to home price trends is how much buyers are actually willing and able to pay for a home in the current market, weighing all the economic factors that go along with making that calculation. If it is a purchase-and-sale transaction, the appraisal is used to determine whether the home's contract price is appropriate given the home's condition, location, and features. In a refinance transaction, the appraisal assures the lender that it isn't loaning the borrower more money than the home is worth. As the above list shows, appraisals are based on a lot of factors, some of which might not have anything to do with the house itself.

MLS is a real estate database that includes home listing and sales information posted by real estate professionals. Although the database is technically private, much of the information is available online for free. A home appraisal benefits everyone involved in the home buying process.

After the home inspection, it is up to the buyer and the buyer’s real estate agent to bring up any concerns found during the home inspection. Repairs could be made or paid for by the seller, or the two sides could negotiate compensation for the buyer to fix any issues after move-in. The home inspection does not involve lenders at all, unless the buyer decides to cancel the sales contract because of the results of the inspection. To get comparative information, appraisers typically review government records as well as home sale information from the Multiple Listing Service (MLS).

The appraisal contingency lets you walk away from a home purchase if the appraisal comes in too low to justify the agreed-upon purchase price. Many factors can affect your home's value, including buyer demand and prices of neighboring homes. The Redfin CompeteScore can give you an idea whether market competition in your area could boost your home's sale price. Or if you're buying, it can indicate how much competition you'll face when you make an offer. Compare Redfin CompeteScores in Raleigh, Philadelphia, Houston, and Sacramento, or check your own neighborhood's score on Redfin.com. Our report includes overall value, estimated price per square foot, property details, sales history of nearby homes and value history.

No comments:

Post a Comment